Drafting An End Of Life Checklist

Creating an end of life checklist is a pragmatic approach to the always challenging task of planning for your final years, months, weeks, and days. Having the discussions early allows loved ones to know and understand your wishes regarding what should happen in the final stages of your life. And while this may still be a difficult discussion to have, knowing that you are drafting a plan that will ultimately ease your family and friends’ burden at an emotional time may make the process easier. Read on as Titan Casket explores the critical elements you should include when drafting an end of life checklist.

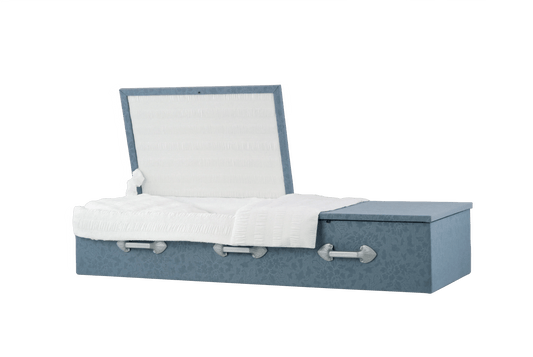

Plan Your Farewell with Grace – Our Pre-Planned Caskets Offer Peace of Mind

What Is Included In An End Of Life Checklist?

An end of life checklist covers a range of topics, including critical health care directives (life support, nursing home use, hospice care, health care proxies), financial plans to streamline the distribution of assets, and pre-need funeral planning. Among the steps you should consider taking

1.Draft End Of Life Planning Documents

Living Trust vs Will

Decide whether you would prefer to have your major assets (home, car, etc.) held in a Revocable Living Trust, managed by your Last Will and Testament or some combination of the two. There are advantages and disadvantages to them both, but it is important to note that only the Last Will can settle issues like guardianship for minor children, property for minor children, and who the estate’s executor will be. Wills are also often used to specify your desires concerning funeral arrangements.

While Last Wills are reasonably easy to draft, Living Trusts are more complicated as they create a trust that handles and, in some cases, distributes assets from your estate while you are still living, as well as after you have passed. A Living Trust also allows for privacy in how your estate’s assets are disbursed, while the Last Will goes through probate court and is a public document.

Living Will

Not to be confused with a Living Trust or Last Will, a Living Will expresses your wishes to family and physicians about medical decisions should you become medically incapacitated. Also known as an Advance Healthcare Directive, a Living Will’s requirements are set by each state, so it’s best to get expert legal assistance when drafting your documents. Typically, people choose to specify their wishes in this document about end of life care, including having palliative care administered but having CPR or other extraordinary measures taken only under very specific circumstances.

Organ and Tissue Donor Documents

You can create a separate document specifying your wishes with regards to tissue and organ donations, as well as a full-body donation to a scientific organization. This process can be as simple as getting an organ donor card or adding an indicator to your driver’s license. If your wishes are more involved, contact your attorney to begin drafting the necessary paperwork.

Durable Financial Power of Attorney

If you have not already done so, consider creating a Durable Power of Attorney that will allow, if necessary, your trusted agent (often a family member) to act on your behalf in financial matters. It’s important to note when granting Power of Attorney authority that you must be mentally and physically capable of assigning that power. General Power of Attorney documents end when you die or become incapacitated – they are best used in limited situations, like extended travel, where you might want someone to make some financial moves during your absence.

A Durable Power of Attorney stays active even if you are deemed physical incapable or mentally incompetent and is only rendered void after death, following an expiration date set in the document (if you chose one), or you revoke it. This keeps your family members from having to go to court to handle your financial affairs should you become incapacitated. Be certain to discuss with your legal representative any restrictions you would like placed in the POA during the drafting process.

Health Care Proxy

Sometimes referred to as a Durable Medical Power of Attorney, a Health Care Proxy designates a trusted family member or friend to make health care decisions for you, in accordance with your known wishes, if you are unable to do so. Your proxy will also have access to your medical records and can have discussions with your doctors about your care, depending on what permissions you outline in the document. Be sure that your proxy understands your wishes with regards to palliative versus extraordinary measures. You will want to explain how your religious beliefs might impact your end of life care and your preferences for particular doctors or medical facilities. If you want at-home hospice care rather than hospital or nursing home care, you should be sure to convey this to your proxy. This information, along with your other end of life care preferences, can also be included in a Living Will.

-

Create An Assets And Liabilities Checklist

Whether you are planning on putting your assets into a Living Trust, distributing your estate through a Last Will, or just want to understand your financial situation better, making a list of assets and debts can be invaluable. Among the possible assets and liabilities to review and inventory when putting together your end of life checklist:

- Properties, Rents, and Mortgages,

- Life Insurance,

- Checking and Savings Accounts,

- Brokerage Accounts,

- 401(k)s, IRAs, Pensions, and Other Retirement Accounts,

- CDs and Treasury Bonds,

- Social Security Payments,

- Car Loans,

- Credit Cards,

- Jewelry,

- Art or Other Valuable Collections,

- Business Concerns, and

- Cash.

Once you’ve established a thorough understanding of what you own and what you owe, you can better begin the process of estate planning. Talk with your tax or financial advisor about the best ways to distribute your assets following your passing. This is particularly important if you have a significant personal estate and/or business concerns. Be sure to discuss any possible ownership issues, such as the future ownership of a business or a home that is still under mortgage now, so that your heirs will not face undue challenges after your death.

Payable-On-Death Beneficiaries

For life insurance policies, brokerage accounts, and similar financial assets, be sure that you have named your “payable-on-death” beneficiaries or that they have been updated to reflect current circumstances. Whoever is designated on your official brokerage documents as your beneficiary will receive the payout directly, and this portion of your estate, if it is governed only by a Last Will, will not go through probate. If you have not named beneficiaries on your financial accounts, they will be divided up in probate court after you die – which can take time and be expensive.

Gifts

In addition to bequeathing specific items or money to your heirs in your Last Will or managing their distribution through a Living Trust, you may be in a position to gift items while you are still living. While larger, insured items that are passed on as gifts may have tax implications, sentimental items can be given freely. And you may want the pleasure of personally giving the gift now rather than waiting for your estate to be settled after your death.

-

Discuss End Of Life Housing Preferences

When putting together your end of life checklist, be sure to start discussing your preferences for where you would like to spend your final years. If you want to remain in your home, talk to your family and your financial advisor about what physical changes might need to be made to the house (stairlifts, roll-in showers, handrails, ramps, etc.), what type of in-home nursing care you might need (or want), and the best way to pay for those things.

If you are interested in transitioning into a nursing home, assisted living facility, or hybrid independent living facility now is the time to start researching the services they offer and the ease of increasing the amount of end of life care you might need. While many assisted living care centers have both independent and nursing care wings, not all do. Some assisted living centers allow you to stay in your apartment and increase your nursing care assistance rather than moving to another area in the facility. If possible, you will want to schedule visits to check out the apartments, the building layout, whether or not you will be able to have a car, what activities are available for residents (both on and off campus), and the overall feeling of the place. Online reviews can also help narrow down your choices.

-

Make Pre-Need Funeral And Burial Or Cremation Plan

When creating your end of life checklist, consider including a funeral plan for your loved ones to follow. Your pre-need funeral and burial or cremation plan can be as detailed or as general as you wish, and it can include everything from the decision to be buried versus cremated to your choice for the perfect final resting place. You can choose your casket from your local funeral home or select a handcrafted coffin or casket from a reputable online vendor, like Titan Casket (and enjoy considerable savings in the process). You can specify your desire for an open casket funeral and name your choices for pallbearers. If you have a favorite reading, song, or flower, you can add those preferences to your funeral plan. Doing this ahead of time means that your loved ones can be sure that your wishes for your final journey are being met while, at the same time, relieving them of difficult decisions during an emotionally overwhelming time.

Creating a pre-need funeral plan is particularly important if you want a “green” burial or desire a DIY funeral with at-home body care. Those plans should be made in concert with the family members who will enact your wishes because they will require quick action following your passing.

Explore the idea of a prepaid funeral plan like Titan Care. This allows you to choose your products, formalize your plans, and pay for them immediately or in installments. You can cover all of your funeral costs or only the costs of the casket or coffin. The best contracts offer you flexibility, they never expire, and are guaranteed by an insurance carrier (Titan Care is arranged through “Global Atlantic Financial Group, and A.M. Best Excellent (A) rated insurance carrier.”)

-

Write How-What-Where Directions

Password Files

Start by creating a password list for your active devices and accounts. If you are suddenly incapacitated or die, your loved ones will need to access your phone, computer, tablets, and other password-protected devices. From there, list information on usernames and passwords for your active email accounts, social media accounts, and social or support groups. This information is beneficial to family members who need to delete accounts or memorialize them after you have died.

Contact Lists

Put together a current contact list or update your address book information so loved ones can be contacted directly. Having this as an item on your end of life checklist will remind you to keep contact information updated, and it will ease the challenges of communicating any significant health changes or your passing to your family and friends. Indicate any doctors who will need to be notified if you are hospitalized out of state or enter a nursing home and are unable to contact them yourself. Identify any neighbors who might be called upon to pick up mail or newspapers or have your spare keys. Don’t forget to include contact information for your employer, religious/spiritual advisor, or volunteer coordinator.

Financial Record Information

Create a section dedicated to your financial records. Let your loved ones know the name of your life insurance company, the account number, and contact information. Also, let them know where your copies of your insurance policies are kept. Similarly, be sure to list where your loved ones can find your brokerage account details, bank account information, any login instructions for managing online accounts, and the location of your safe deposit box, if applicable. Listing the location of your birth certificate, social security card, and Medicare and Medigap policies is also helpful.

Location of Your Last Will

Leave directions for finding your Last Will and contact information for your financial advisor and your CPA. You can include details on who you have named your executor separately, but by leaving the location of the Last Will, your loved ones will be able to get that information when needed. Your Last Will may detail your funeral plans, and being able to access it will allow your family to proceed with funeral arrangements. The Last Will also will provide details about who you have named as a guardian for minor children and any property going to those minors, so it is imperative that your family be able to find the Last Will as soon as possible.

Notice of Bills and Service Providers

Include a list of bills, their approximate due dates, and how the invoices are paid (autopay, check, manual online payments, etc.). This will help your family keep your accounts from falling into default while your estate is being settled. If you have regular service providers, including house cleaning services, furnace/air conditioning maintenance, yard service, pest control, etc., be sure to have the providers’ names and contact information listed.

Save your How-What-Where directions in a secure location that also enables you to make updates to it.

-

Craft Your Obituary

While writing an obituary can be left to your loved ones, crafting your own means that you can spare them this challenging task during an emotional time. It also allows you to have a hand in your public remembrance. It can be strictly factual, include inspirational quotes, and/or humor. It’s up to you. It can get you started, while the final details of the public service and/or memorial will be filled in by your family when you pass.

Do you have questions about other issues relating to your end of life checklist or funeral services? Titan Casket is here to help you get the funeral you want at a fair price.

![Upgrade to Premium Weight [18-gauge steel]](http://titancasket.com/cdn/shop/products/casketthicknesswithnumbers.png?v=1680642906&width=533)